Oct 27 2025

iDEC 2025 Festival officially concluded with an awards ceremony

Oct 26 2025

Prof. Mark Howarth from Cambeidge University will deliver the Award Ceremony Lecture!

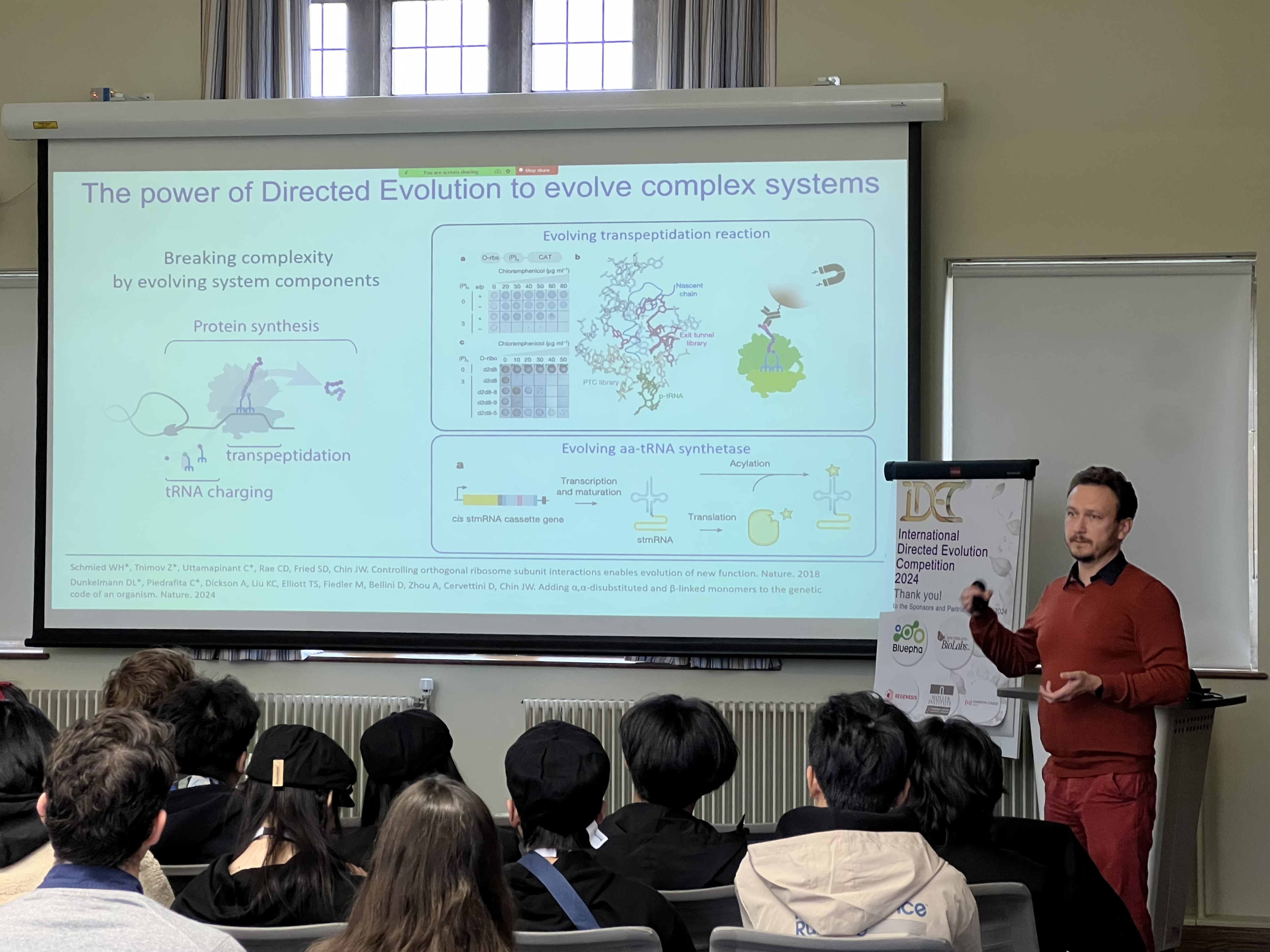

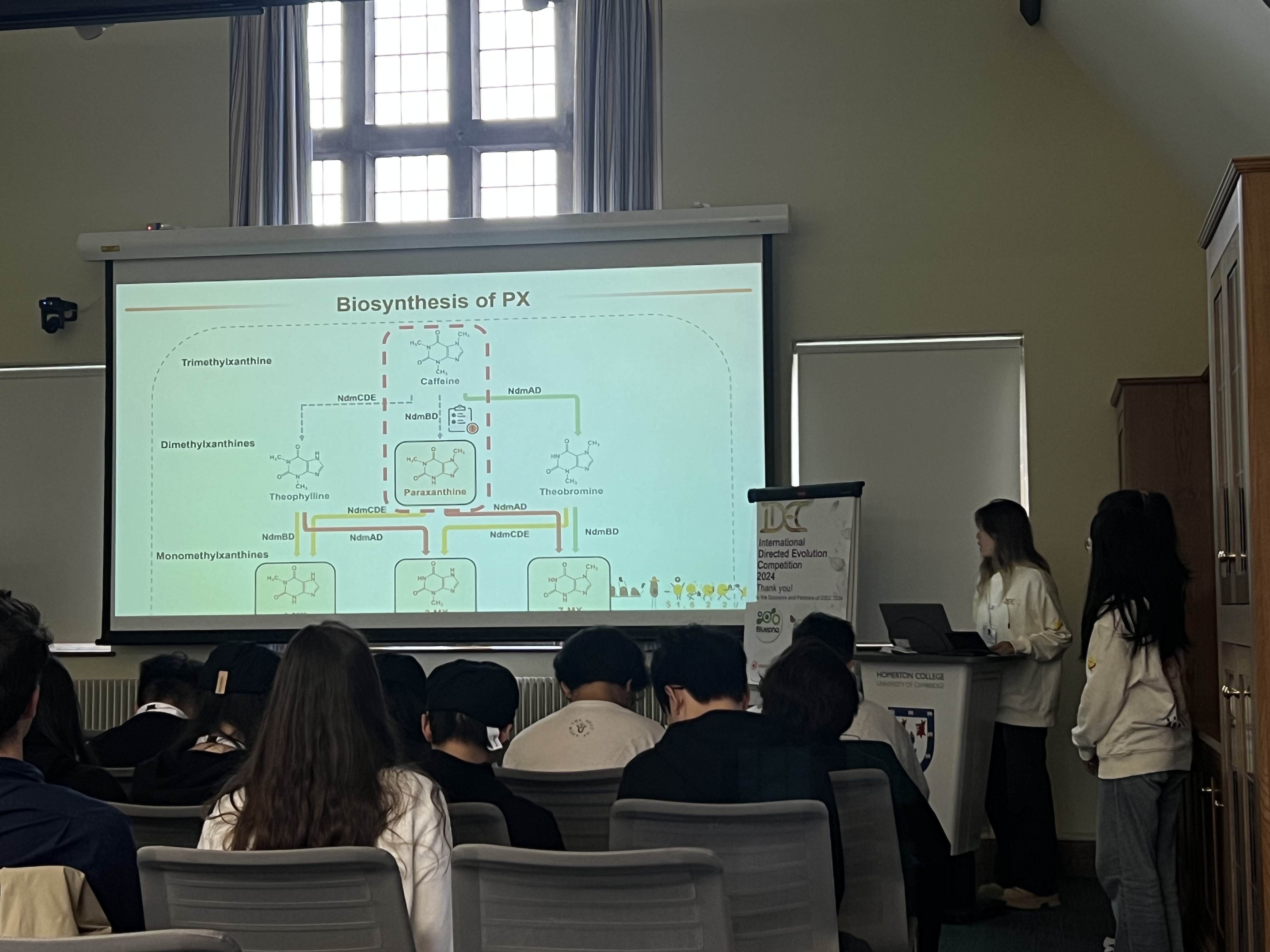

What is iDEC?

The International Directed Evolution Competition (iDEC) is an international public welfare initiative dedicated to building a scientific community to facilitate education, technology sharing, and academic exchange.

How did it start?

iDEC is initiated by scientists and students engaged in genetic engineering research. Our initial volunteer team include members from different countries and cultural backgrounds.

Compete in one, two or three areas of Directed Evolution

Best hardware, Best software, Best algorithm,

etc.

To the best of the best in a unique area.

To consider biosafety, biosecurity, and ethical issues is crucial to establish suitable precautions.

At iDEC, we are committed to teaching how to conduct research responsibly.